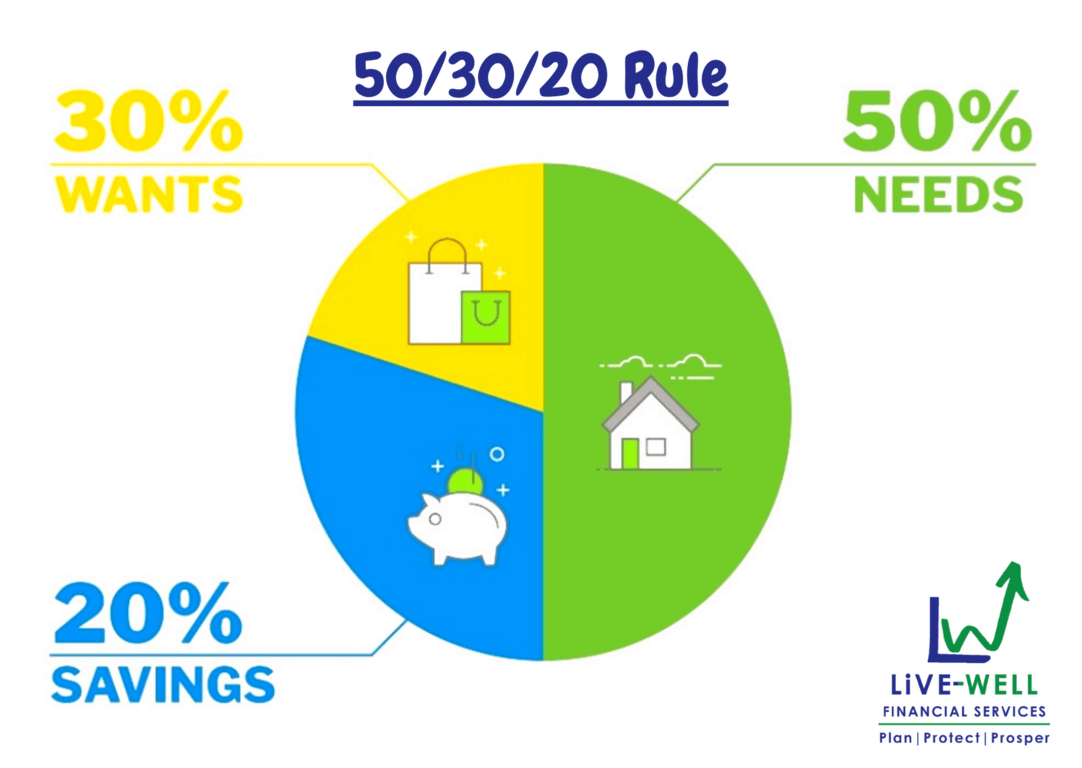

That's because you probably can't sell your other possessions for much but, later in life, you can always sell the home and downsize or even (as a last resort) take out a reverse mortgage. For 2020, 401 (k) contributions are limited to 19,500 for most people, but if youre 50 and older, you can make an additional catch-up contribution of 6,500 this year. Though I exclude all personal possessions, I do include the value of the home in my equation. (Although you should probably not claim your Social Security until 70, in order to get the biggest payout.) On the other hand, if you needed $20,000 annually above Social Security, you'll need to either keep working or learn how to live on less.īy my definition, net worth is the total of what you own less how much you owe. So, for example, if you had a net worth of $300,000 and needed $10,000 a year above your Social Security checks to live on, you have 30 years of financial wealth and might be financially independent at age 65. This rule states that when you get your paycheck, 50 of your money should go toward necessities, 30 of your money should go toward discretionary spending or. Basically, if you're age 50 or older, you can contribute more than.

I define financial wealth in years rather than dollars.

The problem with these rules of thumb is that they are all based on income rather than how much money one needs to live on in retirement.

0 kommentar(er)

0 kommentar(er)